It's no wonder the Dow Jones is now sitting comfortably above 10,000 points. With bank APR's at an all-time low, some people are feeling forced to return to the stock market. I'd follow suit if I didn't feel we were being herded into doing so. Some critics claim that the low interest rates set by the Federal Reserve will fuel a new stock market bubble. Others propose that this is being done deliberately as part of the cycle to create booms and busts in the economy to shift more wealth towards the rich.

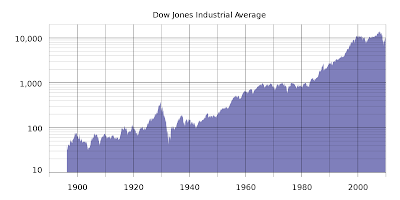

Even if I weren't mistrusting of the Fed's actions, I'm still too skeptical of market fundamentals to rush into the stock market as of yet. The Dow Jones reportedly went from a low of 776 in 1982 to a high of 14,164 in late 2007. That's almost a 20-fold increase within a quarter of a century! In order for investors to experience that same rate of yield, the Dow would have to jump from 10,000 today to 200,000 by 2035. With the performance of the past decade (roughly 10,000 in 2000 back to 10,000 again in 2010), I doubt the fundamentals are good enough to repeat themselves. Hence, today's (and tomorrow's) investors will likely never experience the same gains in wealth as those of the early 80's.

.svg.png) I've always been more averse to risk than embracing of it, and this stance will likely harden with my growing fear of excessive loss of wealth due to market manipulation. Still, 72 years is a long time to wait for my savings balance to double. So don't be surprised if future posts reveal that I've taken the plunge into the market and you find me rejoicing (God-willing) or griping (God-forbid) about stock market performance.

I've always been more averse to risk than embracing of it, and this stance will likely harden with my growing fear of excessive loss of wealth due to market manipulation. Still, 72 years is a long time to wait for my savings balance to double. So don't be surprised if future posts reveal that I've taken the plunge into the market and you find me rejoicing (God-willing) or griping (God-forbid) about stock market performance.

No comments:

Post a Comment